The theme of the past few months: cryptocurrencies. These digital coins such as Bitcoin, Ethereum, and Ripple are based on blockchain technology. Due to the rapid price rise, cryptocurrencies have attracted many new investors to active trading. And many who learn forex trading have started trading cryptocurrencies in addition to traditional currencies.

Anyone who studies the market on a daily basis will soon see that the two products, forex, and cryptocurrencies, behave very differently. That means that as an active trader, you also have to make other decisions. In this article, we will discuss the differences between ‘normal’ currency trading and cryptocurrency trading.

Background

All normal currencies are issued by the central bank of a country (or group of countries). Goods and services produced by that country are paid for in the local currency. If that country’s economy does well, the demand for the currency increases, and it increases in value relative to other currencies. The central bank can influence this by changing interest rates and by putting more or less money into circulation. The market responds to this with supply and demand. As a forex trader, you try to predict this and earn from it.

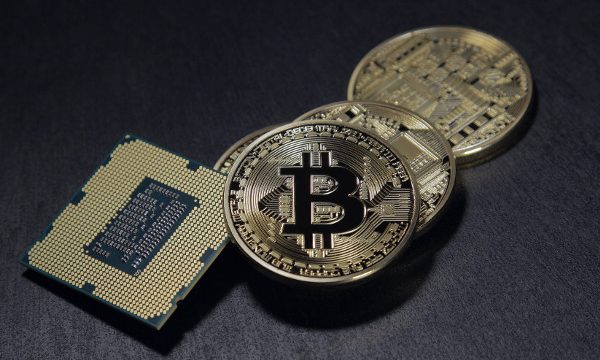

Cryptocurrencies do not belong to any particular country. Coins such as Bitcoin, Ethereum, and Ripple only exist on the blockchain. The blockchain is maintained decentrally and crosses national borders. You can pay with cryptocurrencies at any store or service provider that accepts them, but no one can be forced to take payment in crypto. As a result, the value (in the long term) depends on how many retailers and service providers accept a cryptocurrency.

With cryptocurrencies, there is also no central bank that determines the interest rate or the money supply. Inflation or deflation are ingrained in the cryptocurrency’s code. This differs per coin. For example, the number of bitcoins in circulation is increasing less and less quickly, until it ultimately remains the same at 21 million BTC. The number of ethers in circulation is growing faster than the number of bitcoins, which means that ETH has more inflation. Ripple has a fixed number of XRP that can never increase. Because the supply of a cryptocurrency is fixed in the computer code, the value mainly depends on the demand.

Trading based on the news

If we look around us, we have to conclude that we can hardly pay with cryptocurrencies anywhere. Two years ago, there were still small retailers and cafes that accepted payments in BTC, but the transaction costs have become too high for small payments at the end of last year. This may change with the recently introduced lightning network. Ethereum is used for all programs that run on the Ethereum blockchain, but those programs are hardly used yet. With other cryptocurrencies, you can’t do anything at all.

As a result, the demand for cryptocurrencies is almost entirely speculative. Traders buy cryptos based on the expectation that they will be used in the future. That expectation is not unjustified, because the blockchain is a promising technology. But no one knows for sure which crypto coin has the future.

What we see as a result is that the market reacts extremely to the news. For example, if a large company such as IBM or Microsoft announces that it is partnering with a cryptocurrency, the price can skyrocket 10-30% within a few days. And if a financial regulator of, for example, China says to regulate the trade in cryptos more strictly, the price can fall just as much in a short time. Often such a reaction is exaggerated, and the price corrects itself within a few days. As a trader, you can benefit from this.

ALSO READ: 3 Ways Payroll and HR Use Blockchain

Volatility

This creates a lot of volatility. A currency pair such as the EUR/USD will not quickly go up or down 10% in one day. That’s because everyone has a rough idea of how well the European and American economies are doing. That doesn’t suddenly change by 10%. But because cryptocurrency prices are purely based on future expectations, they can easily fluctuate by 10% per day or more.

A consequence of this is that you have to trade with a smaller leverage factor. For traditional currency pairs, you use leverage to increase your profits. With leverage of 50x, a price increase of 25 pips (approx. 0.25%) turns into a profit of about 12.5%. But if you trade cryptocurrencies with 10x leverage, then a drop of 10% can mean that you have lost your investment, even if the price goes up again afterward. A leverage factor of more than 2-5 is not recommended.

If you want to actively trade in cryptocurrencies, then it is recommended to first develop a feeling for the market. Even if you already have experience with forex. This is possible with a demo account. This works just like a real trading account, except you don’t have to take any risk.

Technical analysis

Because the prices of cryptocurrencies are mainly based on speculative expectations, technical analysis is more important. After all, there is no real crypto-economy with a clearly identifiable value. The value of cryptocurrencies depends on market sentiment. And technical analysis is just right for predicting market sentiment. In addition, you should take into account that not all technical indicators are suitable for cryptocurrency.

Cryptocurrencies are a new phenomenon. The first cryptocurrency, Bitcoin, is less than ten years old. Most cryptos are less than two years old. Moreover, many cryptocurrencies were worth little for a long time and only rose sharply in 2017. As a result, some technical analysis tools do not work well with cryptocurrencies.

Take, for example, support and resistance levels. For many currency pairs, the rates at which support or resistance is experienced can be determined historically. By going back in the chart, we find price levels that the price does not easily break through. Because cryptocurrencies do not have a long history, it is difficult to find support and resistance based on the historical price chart.

Or another important indicator: moving averages. An indicator such as the 200-week SMA (simple moving average) does not exist for many digital coins (because they are less than 200 weeks old). In the shorter term, we can calculate SMAs and EMAs (exponential moving average). But those averages give a distorted picture if the price has risen enormously in a short time.

The most useful indicators for cryptos are pivot points, Fibonacci levels, and Elliot waves. For example, bitcoin’s price chart often shows a rise in five waves and a fall in three waves. Course corrections are often 38%, 50%, or 62% of the peak. And if the price starts to rise again, the new top is often 62% higher than the previous peak. These levels help you to determine your price target and your stop-loss for your crypto trades.

Conclusion

Cryptocurrencies are still very young. They are not linked to a country’s economy, and there is no central bank that determines supply. Since there are still few real applications for cryptocurrency, most demand is speculative. This means that technical analysis is more important than usual. But not all technical indicators apply to crypto.

Cryptocurrencies are extremely volatile. The market often overreacts to news, allowing you to trade on the expected correction. That makes cryptocurrency particularly attractive to active investors, but there are also risks involved. Protect yourself by not trading with too much leverage. And remember: blockchain technology will experience a lot of growth in the coming years.

Crypto influencers face a pivotal choice when building their online presence. Instagram and X (formerly Twitter) dominate as platforms for sharing crypto insights, but each offers unique strengths for audience engagement, reach, and follower retention. For those navigating the fast-paced world of Web3, selecting the right platform can shape their brand’s growth and impact. This article explores how Instagram and X stack up for crypto influencers, diving into what makes each platform tick for this niche audience.

Crypto influencers face a pivotal choice when building their online presence. Instagram and X (formerly Twitter) dominate as platforms for sharing crypto insights, but each offers unique strengths for audience engagement, reach, and follower retention. For those navigating the fast-paced world of Web3, selecting the right platform can shape their brand’s growth and impact. This article explores how Instagram and X stack up for crypto influencers, diving into what makes each platform tick for this niche audience.

South Korea is one of the most active cryptocurrency markets in the world. With a tech-savvy population and a government keen on innovation, the country has played a key role in shaping the global blockchain industry. However, strict regulations and evolving policies continue to influence the market.

South Korea is one of the most active cryptocurrency markets in the world. With a tech-savvy population and a government keen on innovation, the country has played a key role in shaping the global blockchain industry. However, strict regulations and evolving policies continue to influence the market. Cryptocurrency trading is one of the most volatile investment opportunities today, where fortunes can be made or lost in minutes. Artificial intelligence (AI) has emerged as a game-changer, offering tools that predict trends, manage risks, and precisely identify promising coins. This integration of AI into cryptocurrency trading has allowed investors to make smarter, data-driven decisions while minimizing losses.

Cryptocurrency trading is one of the most volatile investment opportunities today, where fortunes can be made or lost in minutes. Artificial intelligence (AI) has emerged as a game-changer, offering tools that predict trends, manage risks, and precisely identify promising coins. This integration of AI into cryptocurrency trading has allowed investors to make smarter, data-driven decisions while minimizing losses.

However, the importance of local SEO is yet to be given full emphasis about its value especially to small businesses and that its implementation is different from national SEO campaigns.

However, the importance of local SEO is yet to be given full emphasis about its value especially to small businesses and that its implementation is different from national SEO campaigns. Although Google may have already indexed your website as a potential provider or source of information, you can reinforce the visibility of your

Although Google may have already indexed your website as a potential provider or source of information, you can reinforce the visibility of your  If you’re into ecommerce as an online retailer, adding cryptocurrency among your payment options is one way to expand your consumer base.

If you’re into ecommerce as an online retailer, adding cryptocurrency among your payment options is one way to expand your consumer base. This should not be an issue because one of the key advantages of dealing with crypto is the avoidance of hefty charges imposed by traditional financial institutions.

This should not be an issue because one of the key advantages of dealing with crypto is the avoidance of hefty charges imposed by traditional financial institutions. Investing in crypto is similar to investing in real estate, but with a few significant differences. One of these is that you can’t touch the

Investing in crypto is similar to investing in real estate, but with a few significant differences. One of these is that you can’t touch the